Housing’s spring selling season is approaching!

Alchemy of Money partners with Certified Financial Planner Stephen Rifici at Ameriprise. I’ve known Stephen for a long time, and we were recently catching up about the spring market, and what real estate entrepreneurs should be expecting. CFA Chief Economist Russell T. Price put together a little outlook and I thought it would be helpful to share with our community:

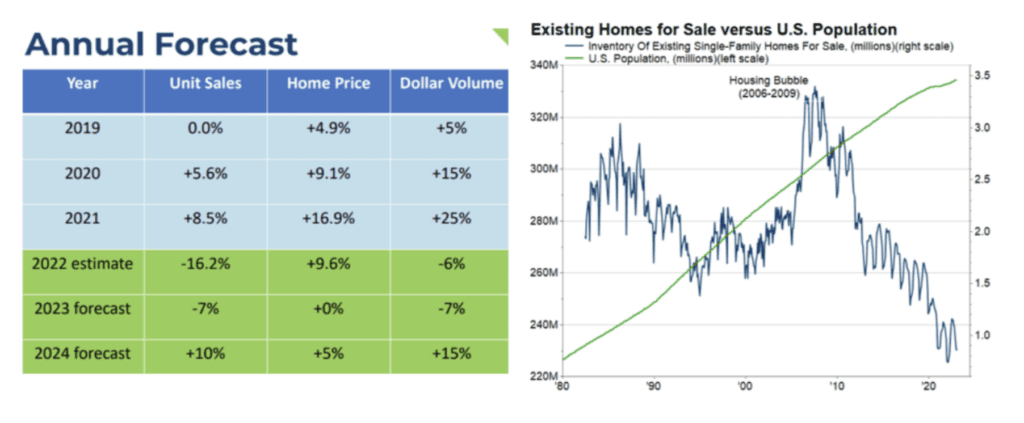

Spring is now less than two weeks away and with it will come the annual spring selling season for the real estate industry. This year’s season begins with the sector under considerable stress from sharply higher mortgage borrowing costs. Existing home sales were down 37% year-over-year in January as the rate on a 30-year fixed mortgage was more than double its year-earlier levels. New home sales have held-up moderately better, showing a 19% y/y decline. Builders are able to at least partially offset the burden of higher rates via incentives, discounts or mortgage rate buydowns. Despite the sharp drop in sales, median existing home prices remained 1% higher y/y in January, according to the National Association of Realtors (NAR), as very tight availability conditions have pressured the supply /demand balance in the sector. The existing home market enters the spring selling season with a near-historic lack of supply, a situation that is offering support to prices. As shown in the chart at right below, the number of existing homes available for sale is currently close to all-time lows for the 41 years of available data. Today’s availability, about 860,000 homes for sale in December 2022 (as per the NAR), is about half the level seen in December 1982 (of 1.9 million). Meanwhile, over that same period, the U.S. population has grown by approximately 43%, according to the Census Department. Outlook: We currently believe the median price of existing homes could decline by 5% to 8% in 2023 as higher interest rates reduce demand and weaken seller pricing power. For its part, the National Association of Realtors (NAR) forecasts existing home sales to be down about 7% in 2023 with median home prices about flat with year-ago levels. The NAR predicts the 30-year mortgage rate to average 5.7% for the year. Looking out to 2024, the NAR forecasts a sales rebound of 10% and a 5% increase in home prices. The table below is sourced from the NAR while the chart at right is sourced from FactSet.